Many grand old companies are facing growing uncertainty because of changing demand and new technology. Some felt that this can be solved by becoming more efficient in the way they deliver and reducing the risk of not meeting delivery targets in time and quality. That explains why agile has turned into a popular way of running projects, and many incumbents are trying to transfer this approach from IT projects to ongoing business activities (e.g. product development, process re-design).

A smaller number of organizations understood that the incremental gains that can be achieved by increasing efficiency while running their business as usual may not be enough when the structure of their industry is being disrupted. These organizations reckon that their effectiveness is at stake, i.e. the adequacy in achieving the goals agreed with shareholders, and that a strategic reorientation may be needed. To make a pivot possible, some have been turning to the tools that allow start-ups and companies like Amazon or Google to put innovating in conditions of uncertainty at their core (e.g. leans start-up, design sprint, working backwards).

Framing innovation in terms of effectiveness rather than efficiency is a tectonic shift in industries where incumbents have always blamed their limited innovation potential to an execution gap, i.e. the sheer disproportion between a big number of allegedly excellent ideas an organization is capable of and the limited capacity to deliver them. That is why already in the early 2000s, banks started applying the discipline of formal R&D processes to services borrowing from other industries. Centralized teams were established with the task of generating new ideas inside-out, selecting those worth pursuing, and testing them with a limited appetite to be proven wrong. In hindsight, the results of these ‘pathbreaking experiments’ did not prove enough to counter a rising tide of industry uncertainty.

Amazon’s outside-in approach

At Amazon, ‘working backwards’ is a structured approach that aims at creating a culture of innovation by developing intrapreneurship in a distributed way.

This starts by asking five questions to clearly identify a job-to-be-done and avoid creating a solution without a problem: “Who is the customer? What is the customer problem or opportunity? Is the most important customer benefit clear? How do you know what customers need or want? What does the customer experience look like?”

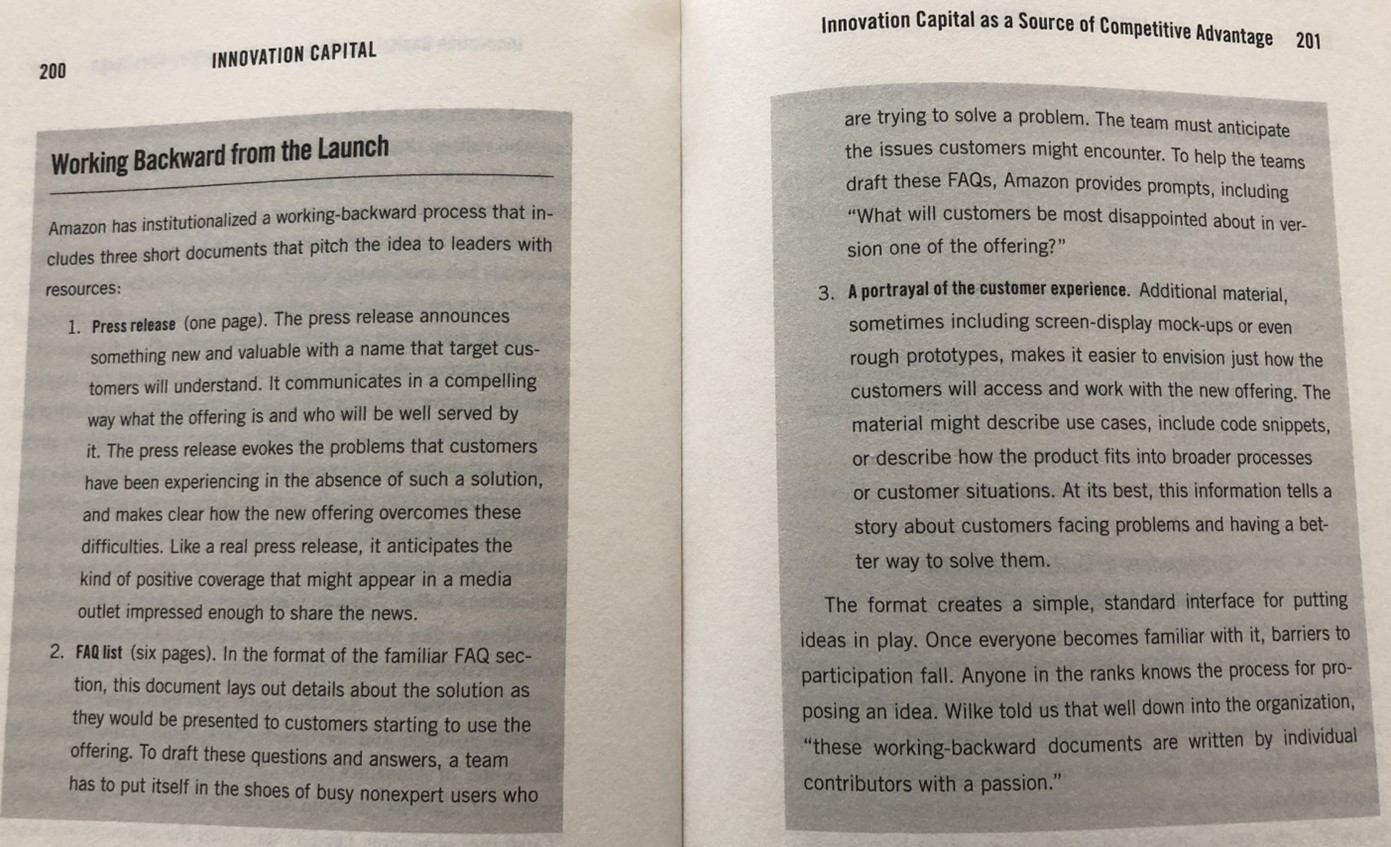

As summarized by Jeff Dyer, Nathan Furr, Curtis Lefrand in The Innovation Capital (2019), the process is based on producing three short artifacts that clearly state a real problem (or opportunity) for the customer, and a way of solving (or addressing) it. This exercise should start from the assumptions that there are no technology constraints, and realtime information as well as perfect insight are easily accessible. The aim is to ‘think big’ and achieve a ‘new unfair advantage’. ‘Thinking small is a self-fulfilling prophecy’, Amazon says.

Few organizations, including the one I worked for as the first in its region, are lucky enough to join the Digital Innovation Program and be coached by Amazon into this new approach, and started adopting it.

The learnings are far reaching as they entails a way of giving green light to experimenting with new ideas decoupled from corporate hierarchy; increasing speed in decision making by building small, cohesive teams instead of complex project charters; incrementally funding new ideas based on milestones achieved rather than tapping into one-off budgets allocated in advance using different heuristics; and tolerating failure at project and individual level instead of keeping initiatives alive with marginal customer adoption.